The cost at which a commodity must be sold in order to recoup the expenses of purchasing and holding it is known as the "break-even price." There are a number of ways that a service or a product may be marketed to pay the expenses of making or supplying it. The break-even value in options trading is the value at which traders may execute or sell the contract without sustaining a loss in the underlying asset.

Recognizing Break-Even Prices

It is possible to apply break-even pricing to almost every transaction. At the break-even point, a house's selling price must cover all of its expenditures, such as its purchase price, interest payments on the mortgage and other debt, hazard insurance & property tax obligations, plus ongoing expenses for repairs, upgrades, and closing fees. There would be no financial gain or loss for the homeowner at this pricing point.

In management economics, the cost of increasing a product's production capacity is calculated using the break-even cost. Because the expenses are dispersed across a larger number of products, lower break-even costs are often associated with higher production volumes. Break-even prices are also used by traders to determine the price at which a deal is profitable after all expenses, fees, and taxes are taken into consideration.

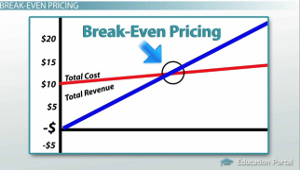

Calculation of Break-Even Price

The break-even cost is the sum of monetary revenues and financial expenditures that is equal to zero. There are no losses or gains made as a result of sales matching expenses in the corresponding transaction. For the purpose of determining a company's break-even point while selling a product or service, the entire cost of a trade or economic activity is used as the target price.

The total of the unit's stable cost & changeable cost spent to produce the product, for instance, would be the break-even cost for the product's sale. As a result, the break-even point is the price at which a product sells for precisely what it costs to make. Taking gross profit margin and dividing it by the total fixed expenses is another technique to figure out a company's overall break-even point.

Business break-even = gross profit margin ÷ fixed costs

Break-Even Price Technique

Break-even pricing is a frequent business approach for young businesses, particularly if the item or service isn't really substantially distinctive from its rivals. It may be possible to get more customers and market share by giving a modest break-even cost with no margin premium, even if this means that the company will not be generating any money at the moment.

For a company to be a cost leader while still selling at the cost that allows it to break even, the company has to have sufficient financial resources to weather extended stretches with no net income. It's possible for businesses to increase prices after they've established market dominance since weaker rivals can no longer stand in the way. A break-even point may be estimated using the following formula:

Fixed costs ÷ (cost - variable price) = break-even point in units

Break-Even Price Effects

Transacting at break-even pricing has both good and negative consequences. As a result of pricing at break-even, new rivals are less likely to join the market, hence reducing competition. This ultimately leads to a dominant position in the market because of fewer competitors.

But if the cost of an item or service is cheap compared to others, people may think it isn't as beneficial, which could make it hard to raise prices in the future. If other companies start a price war, charging just enough to break even wouldn't be sufficient to take over the market. It's possible for a company to lose money when break-even prices fall even more.

Break-Even Pricing Benefits

The break-even pricing strategy has a number of benefits. A firm's break-even pricing plan may dissuade potential new entrants from entering the market because of the low prices. As a second benefit, less well-funded rivals will be pushed out of business. Third, if you can utilize this method to grow production volumes while decreasing costs and making a profit, you may gain a dominating position in the marketplace.

Break-Even Pricing's Drawbacks

A few drawbacks of the break-even pricing strategy should be considered before using it. For starters, clients may quit a firm that just focuses on break-even pricing without enhancing the quality of the product or customer support. For one thing, buyers may believe that an item or service is less useful if the price is cut significantly. This may make it difficult for a firm to raise pricing in the future. Third, the firm may lose market share if its rivals react with even lower pricing.

Conclusion

Companies that can afford to drop their prices while also fending off efforts by their rivals to undercut them would benefit the most from this strategy. The method is challenging for a tiny, resource-constrained firm that can't afford to lose money for long.