Except for royalty payments of $10 or more, this form is not used to report income from other sources. Form 1099-MISC, also known as Miscellaneous Income (or Miscellaneous Information, as it is now known), is a form that is used to report various forms of compensation to the Internal Revenue Service (IRS). These forms of compensation include rents, prizes and awards, payments made to healthcare providers, and payments made to attorneys. This was the case until that year.

Usually, these forms are used to record commercial payments instead of personal ones. A 1099-MISC form is one of several included in the 1099 series. It is also one of the most frequently utilized forms. A short time following the end of the tax year, taxpayers are sent their 1099s, which may include a Form 1099-MISC.

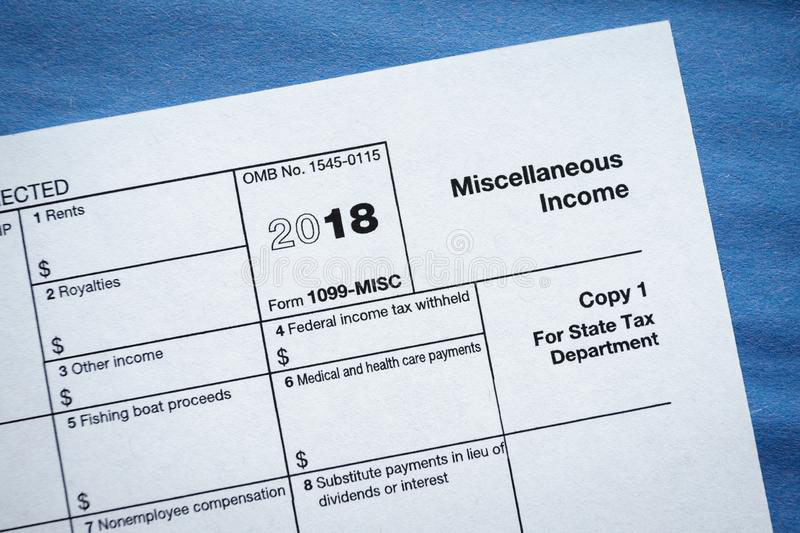

Miscellaneous Income

The recipient of at least $10 in royalties, broker payments instead of dividends, or tax-exempt interest must file and send out a Form 1099-MISC: Miscellaneous Income (also known as Miscellaneous Information). This form must be completed and sent out by the person who made the payment. Additionally, it is sent to each individual in the following categories to whom you paid a total of at least $600 in the preceding calendar year:

- Awards and commendations

- Other monies are received as income.

- Payments for medical services and healthcare (made in the course of your trade or business)

- Proceeds from crop insurance policies

- Payment in cash for fish (or other aquatic life) acquired from someone whose primary source of income is the capturing of fish.

- The amount of money that is transferred from a notional primary contract to a person, partnership, or estate

- Reimbursements to a lawyer or law firm.

- Any vessel used for fishing continues.

Additionally, the form is used to record direct sales of consumer goods totaling at least $5,000 made to a buyer for resale in a location that is not a permanent retail business. Before February 1, the payer is required to mail the form to the recipient, and before March 1, it must be submitted to the IRS (March 31 if filing electronically). The person who receives the form might include it as an attachment to their tax return. In 2020, the Internal Revenue Service (IRS) revised Form 1099-MISC and released a new form for reporting non-employee remuneration called Form 1099-NEC (which was previously reported in Box 7 of Form 1099-MISC).

How to File Form 1099-MISC

On the website of the IRS, you may get a multipart fillable version of Form 1099-MISC. The original Copy A of Form 1099-MISC is colored red. This version of the form is not meant to be printed; it is reserved only for use by the IRS. The black portions of the form are the only ones that can be filled out, downloaded, and printed:

- The recipient's state tax agency receives the first copy of the return.

- Copy B is sent to the recipient, and Copy 2 is delivered to the recipient to complete their state tax return.

- The payer will keep hold of Copy C for their record-keeping purposes.

The person making the payment must provide their name, address, and taxpayer identification number, and the person receiving the payment must also provide their name, address, and Social Security number. On the updated 1099-MISC form, various types of payments are reported using different box numbers. For instance, rents are reported using Box 1, whereas royalties are reported using Box 2. Additionally, if it applies, you must fill out Box 4 for the amount of federal income tax withheld and Box 16 for the amount of state tax withheld.

- 1099-MISC for 2022

- 1099-MISC for 2022.

Additional 1099 Forms

The following is a rundown of the several types of 1099 forms, along with their respective functions:

- 1099-A: Acquisition or Abandonment of Secured Property 1099-B: Proceeds From Broker and Barter Exchange Transactions [1099-A: Acquisition or Abandonment of Secured Property]

- Debt-cancellation is reported on Form 1099-C, while corporate control and capital structure changes are reflected on form 1099-CAP.

- Dividends and Distributions Reported on Form 1099-DIV

- 1099-G: Statement of Certain Payments to the Government

- Health Coverage Tax Credit (HCTC) Advance Payments are reported on Form 1099-H.

- Interest Income on Form 1099-INT

- 1099-K: Transactions Made with a Payment Card or Through a Third Party Network

- 1099-LS: Reportable Life Insurance Sale

- Long-Term Care Expenses and Accelerated Death Benefits, Form 1099-LTC

- Original Issue Discount (also known as 1099-OID)

- 1099-NEC, often known as the Nonemployee Compensation form

- Distributions That Are Taxable And Were Obtained From Cooperatives, Form 1099-PATR

- Distributions Received From an HSA, Archer MSA, or Medicare Advantage Plan Are Reported on Form 1099-SA MSA

- The 1099-SB form reports the seller's investment in a life insurance contract.